Popular Articles

Silver Receives "Bear Market" Label-Jon Nadler-May 17, 2011

Futures Magazine noted the silver top call.

What Is the Fair Value of Gold? Ask Stocks.-September 7, 2011

This article was extremely bearish on gold within one day of gold’s all-time high.

Bullish Signs for Stocks, Silver-October 6, 2011

This was 2 days after the April to Oct 4, 2011 -21.5% correction bottom. The market did not have another correction for 3.5 years.

Silver May Be Trading Below Its Recent Inflation-Adjusted High in the Year 2139-February 16, 2012

Back to being bearish on silver.

Tracking the 10-year Note: Indicator Hitting All-Time Low Says Stocks Will Hit All-Time High-April 11, 2012

Suggested the S&P would hit 1800.

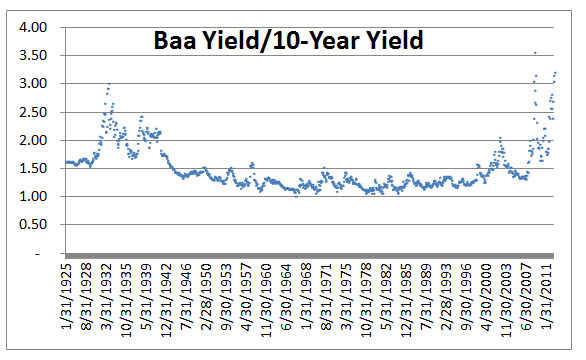

Another Bond Indicator Suggests Stocks Will Hit All-Time Highs-August 2, 2012

Predicted a 37% to 54% stock market rally over the following 16 to 18 months. Stocks ended up going up 35.59% in 17.4 months.

TIPS Reaches an All-Time Record Low of -1.67%. What Are the Implications?-September 20, 2012

Gave sell recommendation to 5-year TIPS. This article was within 6 calendar days of the 5-year TIPS all-time highs. Note this was Absolute Value's first TIPS article, thus making it likely the greatest sell call in TIPS financial history.

When Will Expected Inflation Hit 2.5%?-December 13, 2012

Called the 10-year note & 30-year bond the most overvalued in history 3 days after the 10 and 30 year TIPS all-time high. Note this was Absolute Value's first article on 10 and 30 year TIPS, thus making it likely the greatest sell call in 10-year and 30-year TIPS financial history.

Commodity indicator hits the 2nd highest daily overbought reading in history-March 9, 2014

The short lived commodity bounce is over and it is time for another leg down.

History Shows We Should Expect a Gold Stocks Bear Market in 2014-April 15, 2014

The endless bear market continues in gold stocks.

4 gold stock indicators giving off rare signals - January 13, 2015

Predicted a top in a week. Actual top was 8 days later.

5 gold stocks indicators giving off rare signals - January 22, 2015

Gold stocks went down 24.92% from January 21, 2015 to March 11, 2015

|

Wealth and Finance International names Absolute Value Capital Management 2015 Hedge Fund Manager of Year

Acquisition International 2016 Fund Awards: Best Onshore Equity Hedge Fund -Absolute Value Capital Fund, LLLP

Corporate America Magazine named James Debevec II the 2016 Hedge Fund Manager of the Year.

Absolute Value Capital Management, Inc. has been chosen by AI as the USA’s Most Innovative Hedge Fund Manager of the Year.

Absolute Value Capital Management recieved the highest numerber of nominations in the Hedge Fund Manager of the Year category and won the ACQ5 US-Hedge Fund Manager of the Year Award 2016.

Ranked the #1 hedge fund in the world year-to-date by numerous databases for 31 months (January 2002-December 2002, January 2014-August 2014, February 2015-December 2015).

Absolute Value Fund was the best performing hedge fund in 2002.

Historical Charts

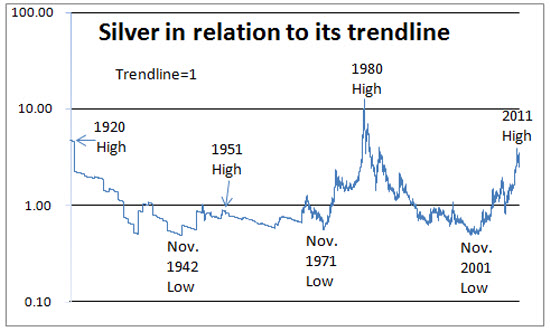

Trendlines Suggest Silver's Fair Value To Be in the Pre-Teens-September 28, 2011

On the date of the article, silver closed in the $30s. On December 14, 2015, silver hit $13.73.

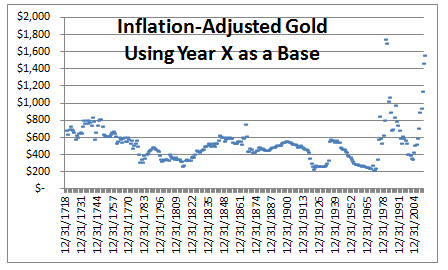

Is Warren Buffett Correct About Gold?-February 29, 2012

From the date of the article to the December 2, 2015 low, gold declined by over 39%.

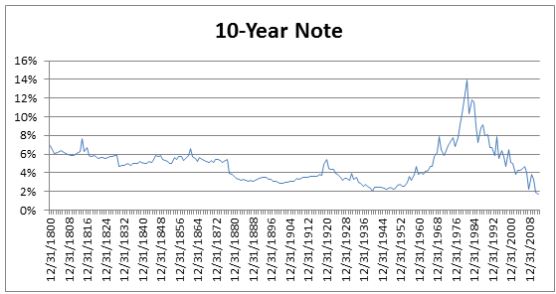

10-Year Note Yield Hits All-Time Low-May 30, 2012

From the date of this article until the December 2013 research report

which reversed this call,

bond yields went up over 40%.

Indicator at Levels Only Seen Near the Epic 1932

and 2009

Stock Market Lows

-August 17, 2012

This article predicted the S&P would hit 1800 by Nov. 30, 2013.

On November 30, 2013 the S&P closed at 1805.

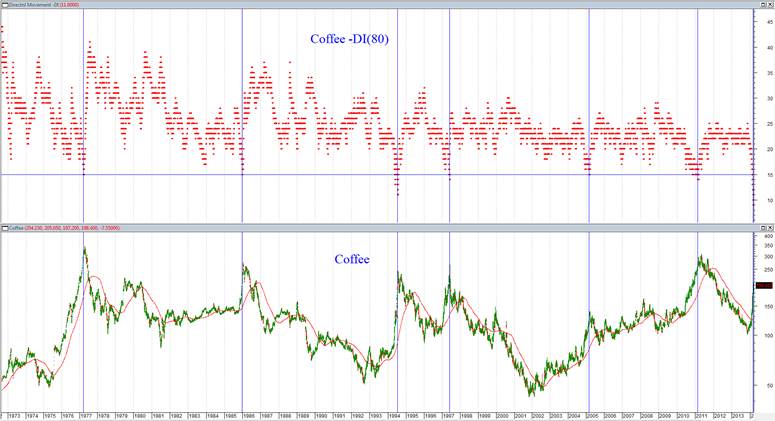

Coffee most overbought since at least 1972-March 16, 2014

From the date of this article to its September 24, 2015 low, coffee declined by 42.26%.

|