Coffee most overbought since at least 1972

March 16, 2014

Coffee has doubled in less than four months. One coffee indicator is at its lowest level since at least 1972. This research report will examine this indicator and see what has happened next after prior low readings.

The indicator we are going to look at today is the Coffee Negative Direction Indicator (80). The 80 represents trading days. To calculate the Negative Direction Indicator, one needs intraday highs and lows. The available intraday coffee data starts on August 24, 1972. Therefore, that day is the inception date of our study.

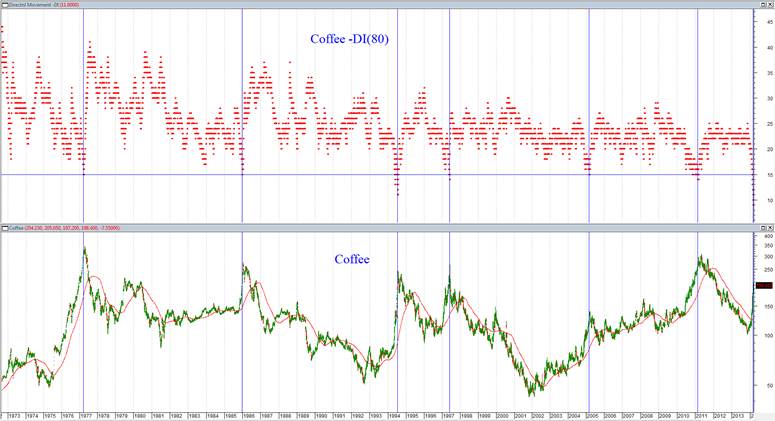

Here is the chart:

The top chart is of coffee –DI(80). The bottom chart is the price of coffee. As you can see when the indicator in the top chart has reached a low, coffee has declined.

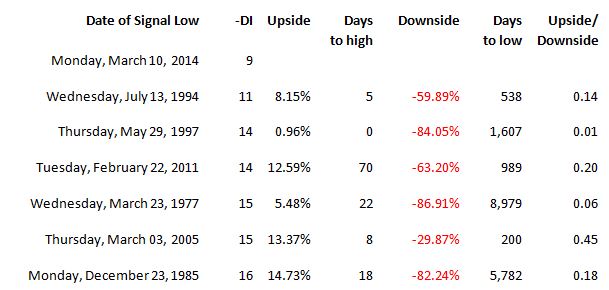

The following is a table of the dates designated by the blue lines in the chart:

The Upside/Downside and days to high/low are all from the signal date. This table does not include the days near an extreme reading. The extreme reading is the low reading for each group. There are times when the indicator has multiple readings next to each other at the same number. For example, the lowest reading in history was 9 on March 10-13. In an effort to promote conservatism, the earliest date is chosen.

Last week’s research report examined an indicator that has led to coffee going down 36.84% in 192 days and 45% in 283 days. There was a March 2005 signal in both last week and this week’s indicators.

So how do you know when coffee is at a top? Here are the first few days from each top listed above:

As you can see, the declines are precipitous.

From May 3, 2011 to November 14, 2013, coffee dropped by 66.49%. On December 15, 2013, Absolute Value Capital Management (founded in 2001) issued its first ever report on coffee. Coffee’s price was $115.25. At the time the internet wasn’t exactly flooded with people who were recommending buying coffee. Coffee was at $196.85 last week when Absolute Value Research noted commodities were overbought. Today’s research report provides further evidence to the bearish hypothesis. The reward/risk for owning coffee is extremely low. A coffee indicator which has a perfect track record for at least 41 years is at its all-time bearish extreme. If there are any remaining gains left in coffee, they are likely to be given back in the coming months ahead.

|