Copper indicator hitting all-time low suggests copper will hit an all-time high

By James V. Debevec II

December 22, 2013

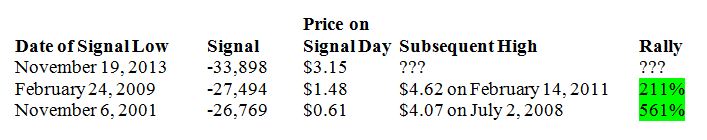

In the November 19, 2013 U.S. Commodity Futures Trading Commission’s Commitments of Traders Report, the Copper Non-Commercials Net Position was -33,898 contracts. That was an all-time low. Extremes indicator readings often occur at inflection points. This article will explain this indicator in detail and demonstrate its predictive value.

The United States Government is a political unit which performs functions such as running the

U.S. Commodity Futures Trading Commission. The CFTCis the watchdog of the futures market. It also produces the

Commitment of Traders Report. The COT “provides a breakdown of each Tuesday’s open interest for markets” such as

Copper which is a commonly used industrial metal. The market participants who bet on the price direction of this commodity are divided into three categories, one of which is called the

Non-Commercials. The NCs are widely considered to be hedge funds. Adding the NCs copper long contracts and then subtracting from that number their copper short contracts gives us their

Net Position which was -33,898 on November 19, 2013.

The three categories are:

- Commercials=Hedgers=Very Large Market participants that often own the underlying asset (i.e. copper mining companies)

- Non-Commercials=Large Speculators=Hedge funds

- Non-Reportable=Small Speculators=Retail investors

Commercials- It can be confusing to call them hedgers because Non-Commercials are often called hedge funds. Also they are very large market participants not to be confused with large speculators.

Non-Commercials-This is an extremely misleading name. “Non-Commercials” are people who are not commercials but also they have to report their trades to the CFTC. Paradoxically, a Non-Reportable is not a commercial but it is NOT a Non-Commercial. And if that wasn’t enough, the Non-Commercials are often hedge funds which sound a lot like the hedgers which the commercials are often referred to. Sometimes hedge funds are even nicknamed “hedgies” which sounds even more like hedgers. The CFTC must have had Abbot and Costello’s skit writer come up with these names. Let’s call this class Large Specs.

Non-Reportable-small specs-retail-at least this one is not confusing since the other two have to report their trades to the CFTC. Let’s call this class Small Specs.

Each of these three categories is broken down into three additional subcategories-long, net and short. While this makes for a total of nine subcategories, there are only six input numbers. The three net numbers are derived from the longs minus the shorts for each category. Let’s look at the contracts for copper as of November 19, 2013

Asset |

Category |

Position |

Contracts |

Longs |

Net |

Shorts |

Copper |

Commercials |

Long |

98,110 |

98,110 |

|

|

Copper |

Commercials |

Net |

38,868 |

|

38,868 |

|

Copper |

Commercials |

Short |

59,242 |

|

|

59,242 |

Copper |

Large Specs |

Long |

40,413 |

40,413 |

|

|

Copper |

Large Specs |

Net |

(33,898) |

|

(33,898) |

|

Copper |

Large Specs |

Short |

74,311 |

|

|

74,311 |

Copper |

Small Specs |

Long |

19,855 |

19,855 |

|

|

Copper |

Small Specs |

Net |

(4,970) |

|

(4,970) |

|

Copper |

Small Specs |

Short |

24,825 |

|

|

24,825 |

Copper |

TOTAL |

|

|

158,378 |

- |

158,378 |

Everything balances. The longs equal the shorts and the sum of the net numbers is zero. So whenever somebody says something like “people are heavily short gold right now”, in the futures market it is nonsensical. There has to be somebody on the other side of the trade. Futures and options markets are zero sum games. If the shorts are right, who is going to pay them? Having said that, when you hear a comment like that it usually means the hedge funds are heavily short.

Next question…there are nine different indicators. Why pick the Large Specs Net over the other eight indicators?

For whatever reason, in the copper contract, the Large Specs Net seems to be the best COT subcategory in predicting the future price of copper. Most of the other eight contracts do not seem to be of much use. Every asset is different. Many assets do not have any predictive subcategories at all.

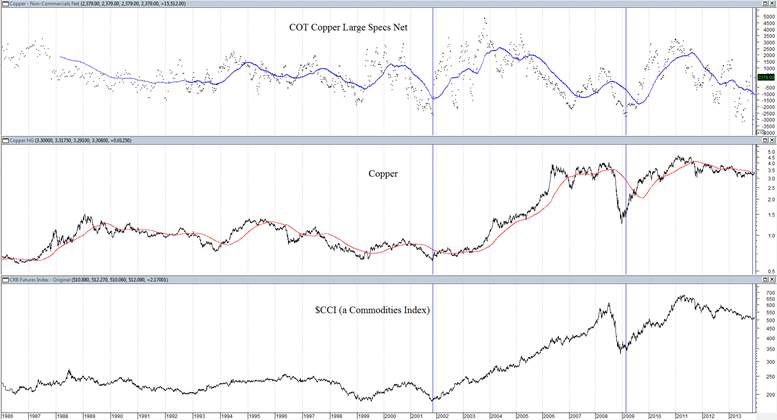

Let’s take a look at the chart of Copper Large Specs Net since its January 15, 1986 inception:

The indicator is the top chart and copper is the middle chart. The three blue lines are drawn at the indicator lows of the year for the three lowest years in the history of the COT.

The Large Specs were -31,689 on June 25 which was also an all-time record at the time for the indicator. A cynical observer may point out that there haven’t been any 500% rallies since then. That may be true, but the copper low over the last 3.3 years was $3.0245 on June 24. The current situation somewhat resembles the 2001 situation when the indicator and copper reached a low, copper and the indicator rallied and then both copper and the indicator retested the low a number of months later. This was followed by an epic rally in copper.

The bottom chart is commodities. The commodity chart is remarkably similar to copper. While this indicator is based on copper, one cannot deny how this indicator went off near the bottom of the two biggest commodity rallies of the last 33 years. This is rather interesting because the last two weeks Absolute Value Research has published research reports which have been quite constructive on corn and coffee. More on this next week.

How to play the copper bull market

The futures market is the most efficient way to buy copper. Click here for a list of all the copper futures contracts. At the time of this writing, copper is in a state of backwardation. The further out in time you look the cheaper copper gets.

This month’s contract is December 2013 at $3.349.

The benchmark (heaviest volume and most widely quoted) contract is March 2014 at $3.3055.

The furthest out contract (which has recently traded) is March 2015 at $3.275.

This is good for the copper bulls.

In the confines of the November 7, 2001 to July 2, 2008 copper secular 573% move, the first bear market was from May 11, 2006 to February 2, 2007. So copper went up 547% for 4.5 years before having a bear market.

In the confines of the December 24, 2008 to February 14, 2011 copper secular 271% move, the first bear market was from April 5, 2010 to June 7, 2010. So copper went up 191% for 15 months before having a bear market.

Since copper bottomed on June 24, 2013 at $3.0245, this would suggest you would want to buy copper contracts which expire on September 2014 or later (i.e. 15 months). The volume for those contracts is not high so you may have to work yourself into a position over time.

Despite the low volume of the far out contracts, the futures are still a better bet than the copper ETNs. The most popular way to play copper via ETNs is JJC. The basic problem here is this security tries to replicate the benchmark contract index. This means the copper contracts JJC holds are typically a few months out at the most. So if the 2015 contracts go up in price faster than the 2014 contracts, when the benchmark contract gets closer to expiration and the fund manager of JJC has to switch to the father out contracts, he is going to have to pay up for the contango. If copper prices go up, this scenario is extremely likely to happen if you think about it. It would be extremely unusual for you to own JJC (which owns the benchmark contract) and all the prices in all the contracts went up by the same exact amount, and then when the ETN manager switches to the next contract, all the contracts would go up the same amount again and again. Much more likely is the benchmark contract will go up 10 cents and the other contracts go up 12, 13, 15 and 17 cents etc. Then when the ETN manager has to switch to the next contract prices will have had already gone up a bit.

There is another copper ETN with a ticker symbol of CUPM. The basic gist here is the ETN manager tries to mitigate the effects of contango by figuring out which contracts to buy by use of a secret formula. Theoretically, there is no advantage of this unless the secret formula works. But since the COT indicator suggests this will be a longer term rally, CUPM initially seems to be a better bet than JJC because CUPM is more likely to have longer term contracts than JJC. However, this perceived edge is mitigated by the fact that is the average daily dollar volume for CUPM is $4,859.

If history repeats, copper will hit an all-time high. The most efficient way to express one’s belief in a long term copper bull is by purchasing contracts in the futures market which will expire September 2014 or later.

Indicator: COT Copper Non-Commercials (Large Specs) Net Position

Inception: January 15, 1986

Frequency: Two times a month through September 30, 1992, then once a week

November 19, 2013 Percentile: 0.0%

December 17, 2013 Percentile: 46%

James V. Debevec II is the founder of AbsoluteValueResearch.com |